Finding the White Space: 5 Strategies for Disruption

Earlier this year, I attended the World's Fair Nano in San Francisco. Among, the forward-thinking speakers who spoke of promising technologies, ideas, and processes was a visionary who discovered a formula for disrupting long-standing saturated incumbent industries. Despite his youthful appearance and artistic flare, his resume is long and successful — you may already know him. And, if you don't know him, you are most likely familiar with his products. After all, they are in millions of homes around the world.

Throughout his career Eric Ryman, has managed to re-imagine product industries that were considered at times immutable by experts. He was one of the creative brains behind Method house cleaning products, and, most recently, Olly Nutrition. Both, began in industries that were full of competition but in his mind ripe for disruption.

Method Products, a household product, made toxic-free and aesthetically pleasing bottles a thing before it was something millennials new they wanted it. And, his more recent venture, Olly Nurition is making nutritional goals simple, refined and, and most importantly, tasty. The magic of his success and many entrepreneurs like him such as Brian Chesky (Airbnb), Elon Musk ( Tesla, Space X), Mark Zuckerburg (Facebook) and Arron Levie (Box) has been their ability to see what's missing in the world. This missing thing, called the "White Space" has led to big ideas and even bigger disruption to markets.

Finding it, has been the secret to beating incumbent companies that have more often than not become too big, slow and comfortable with their own processes to realize there is something missing in the first place.

Disruptive Innovation

I get it. More and more, we are hearing the word disruption. Some play it off as a no more than a buzz word, but it's effects are very real and something every incumbent company should have a strategy in defending if they want to survive the transition into 4th Industrial Revolution. But, what is disruption, actually and how do you achieve it?

Defining Disruptive Innovation

Disruptive innovation happen in industry anytime a product or service is introduced that require us to change our current behaviors in business or in product. This discontinuity often becomes problematic for large organizations who have spent millions implementing business processors or customers who have grown accustomed to a certain product or service. Thus the initial trigger response by most in this disposition is resistance, skepticism and trepidation. But, this should not be the response any longer. The rate of market disruption has drastically accelerated. Companies that took decades to build and who fail to respond to emerging trends are getting beat by new companies within just five or so years. Infact, the average lifespan of a company on the S&P 500 has decreased from 90 years in 1935 to 18 years today.

A Bell Curve for Disruption

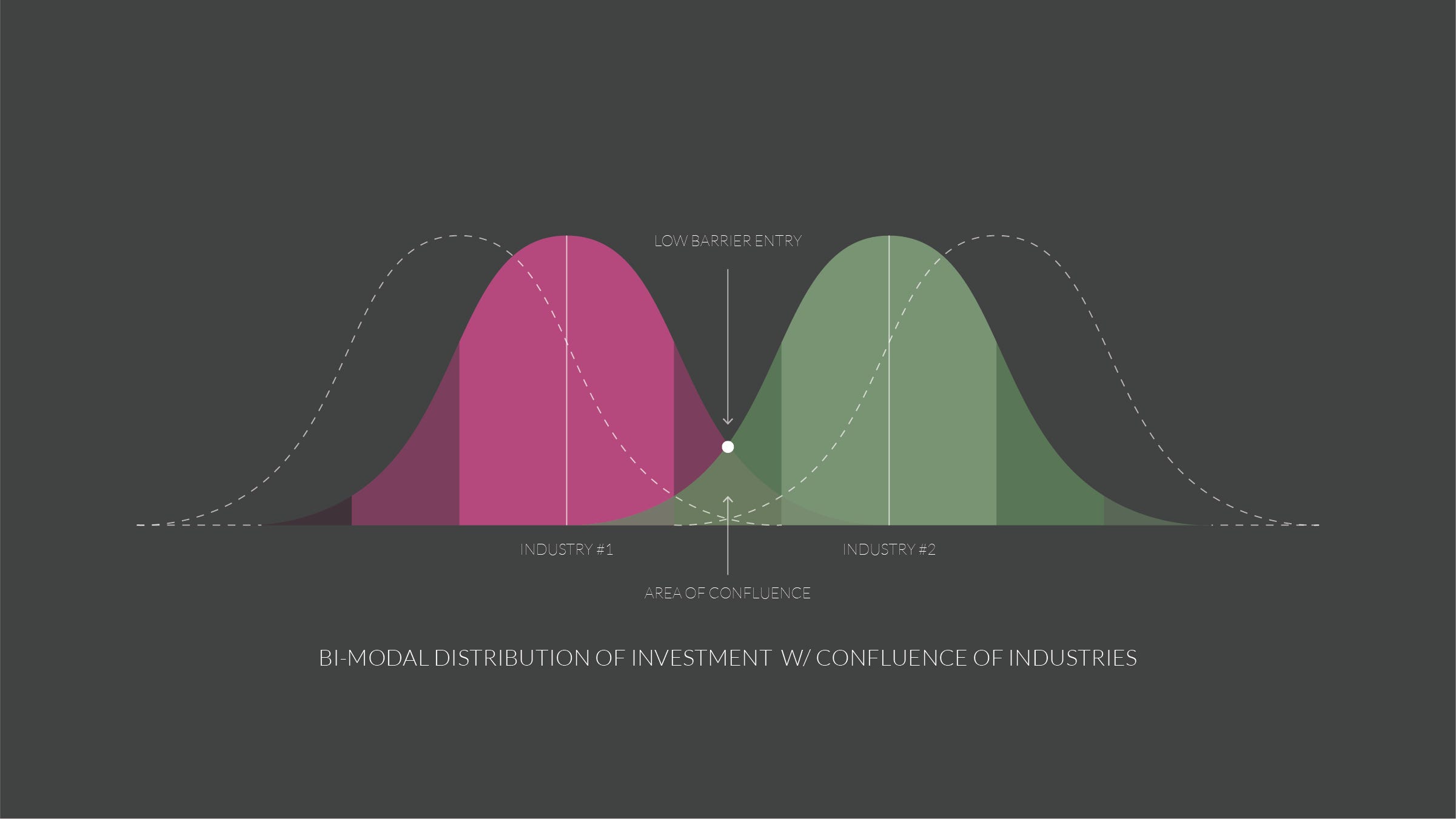

Achieving disruption via leveraging "white space" I think is best visualized by mapping emerging industry trends and investment into lines of business on a bell curve. Most incumbents companies have a core line of businesses or products that they focus on. If we think of the area under neath the curve being proportional the company investment of time and resources, the main lines of business can be considered to be within a single standard deviation from their top selling product or service.

If your industry is cars, you are not going to typically invest in developing construction equipment, or battery storage ( **cough** Elon Musk **cough*). You may consider adding a Truck or SUV to the product line-up and parts division to supply maintenance service provides- secondary lines of business, which might be found 2 deviations from the top selling product service. But, you don't go much further than that. As a result, incumbents companies tend to dominate these regions and thus create high barriers of entry to market for new competitors. At the tail, of this bell curve host most R&D projects, moonshot ideas, and tertiary lines of business that if you implemented into a business today would introduce disruptive behaviors and processes. As such, the typical strategy for most vertically integrated, incumbent companies is to slowly drip resources into the tail and bolster the spread of market dominance gradually over time.

But, what happens if we introduce variance by adding another industry or consumer goal that falls outside of a current companies central tendency?

Very quickly we develop a noticeable gap. There is a heterogeneous bi-modal distribution of market ownership that introduces low barrier entry points for new competition and ideas to enter the marketplace. This is the "white space" for entrepreneurs and startups — a sweet spot for disruption, because it requires minimal resources to compete, has little investment from industry incumbents, and low levels of competition. How big this gap or "white space" is, usually, determined by the confluence of these markets at a given time.

Let's use a familiar example: A vehicle and a edge-to-cloud computing have very little to do with one another until you add computer vision, a segment of Artificial Intelligence, that allows the vehicle to "see". Over the next few years, we will see these 3 industries converge and skew the normal business trends of each industry to establish the "autonomous vehicle" market.

And over this time period, more and more businesses will enter into the "white space" between industries filling it and adding to the area of confluence. After a certain point, the area of confluence will hit critical mass where the incumbents companies must skew or shift from their normal operation of business or risk losing market dominance to the rising tide of companies. Large companies usually choose to achieve this shift by acquisition, competition or partnership.

Currently, we are seeing accelerated research and development in future transportation technology by incumbent companies like Ford, Mercedes Benz and Toyota who incorrectly predicted the rate of confluence — growth of technology expertise plus industry bias over time — for autonomous and electric cars. Ford, for example, just spent 1 billion dollars in a recent acquisition of autonomous start up Argo AI to catch up with the rate.

5 Strategies for Adopting the "White Space" Mentality

So, if you are looking to achieve success disrupting established industries you must develop a strategy to enter the "white space". So, here are 5 strategies with successful examples to differentiate yourself from the incumbent companies and disrupt the industries of today.**

** As a warning, these strategies are not very applicable to apply from inside most well-established companies. You will probably get told the following by your leaders: "That idea is too big for us to achieve, right now!", "We can't do that!", or "Leave that to the R&D Department!". Trust me from personal experience. There are other ways to drive innovation within corporations, which I will explain in the future.

Strategy 1: Find Two Relatable but Fundamentally Different Industries That have a Low Barrier to Entry

As the above diagrams explain, the first strategy in finding the "white space" is leveraging the in-between of two industries or ideas that have big markets, are relatable but are not currently associated with one another.

Tesla was able to successfully incorporate this strategy by developing a sports car that was electric for a high-end buyers. The "sports" aspect is important because electric cars have almost instant acceleration, which means you get the performance of a Ferrari for a fraction of the cost. In addition, going electric allows you to digitizes the most of the car infrastructure and decreases the number of moving parts- meaning less maintenance. The digitization of car allows Tesla to update the software and firmware overtime to increase performance- a strategy that is typically associated with the technology industry and not the transportation industry.

Strategy 2: Pay Attention to the Pain Points of Current User Experiences

The enterprise file sharing solution, Box, was started in 2005 because the founder were frustrated with how hard it was to share and access files. There was no Google Drive back then. As it turns out, employees of organizations were also deeply frustrated with enterprise IT solutions developed by their companies, which were slow, complex, and clunky to use. This type of user experience increased the friction to achieve a goal, which led to many people not even using their own company's technology. Meanwhile, leadership kept investing in a broken solution, and file sharing became more adhoc creating security and integration issues.

Box simplified the user experience of enterprise file sharing software, provided enterprise security and made their software open to anyone who wanted to use it. As a result, people started using box over in-house file sharing software. They now currently, support 63% of Fortune 500 companies file sharing services.

Strategy 3: Determine a Confluence of Trends and Inflection Points that Will Change a Market

When Amazon was experiencing customer shopping issues due to rising demand during peak shopping seasons they had to purchase more servers in order to support this behavior. Although the surplus of servers created a stable network infrastructure capable of taking on the busiest of shopping days, when the server wasn't at peak capacity they had a lot of extra computer power and storage that was sitting idle. Thus, someone recommended they sell the extra storage to companies who might need servers for their e-commerce business, as well. Afterall, Amazon had spent millions on how to perfect the process and technology.

As a result, Amazon developed Amazon Web Services which provides almost infinite computing and storage power and provided access to the network economy at a lower price. As a business, you didn't need millions of dollars to provide a stable and scalable online business. As of today, AWS makes up for over 10% of Amazon's yearly revenue and continues to grow at almost 50% year over year.

Strategy 4: Exploit Business Model Asymmetries of Incumbent Companies

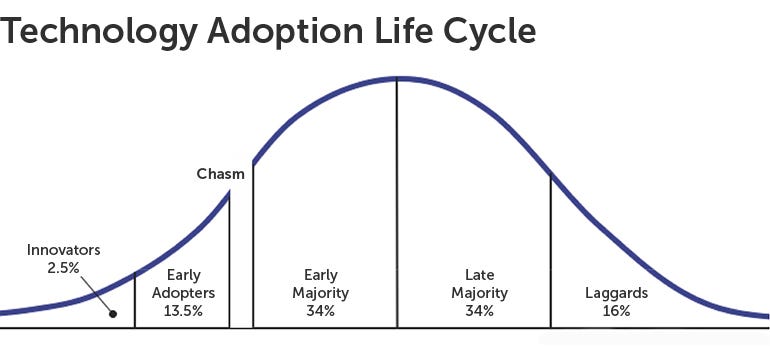

The biggest advantage of startups or new projects is you start with nothing but ideas. There is no change management to consider, barely any politics, and there is little risk n accruing substantial capital losses. Incumbents on the other hand have many people to please and executives have reputations to uphold. As a result, incumbent companies tend to be risk-averse and don't want to make big bets on ideas that are not proven. They tend to play the "let's wait and see" card, which is a risky game if you move too late (just ask Blockbuster and Polaroid). They have a late majoritymindset on the Technology Adoption Life Cycle.

One day, Eric Ryman's then-girlfriend asked him why Pine-sol couldn't be designed more like Snapple's Elements — a premium line of beverages. Where she saw a problem, he saw an opportunity. He wanted to close the the "cultural gap" between what people wanted and what cleaner products were back then. Thus he, along with some friends, created Method, a household cleaning product company, that was made free of toxic ingredients and was appealing in bottling. It created a set of cleaning products you were "happy" to put on your bathroom counter. And, since then it Method has set off a toxic-free revolution of cleaning products.

Strategy 5: Stay Small, Validate Market Fit , Then Rapidly Scale

The biggest advantage that most start-ups have is their ability to create change due their relatively small size. Changes can be made within hours or even minutes. Creating change across an organization of 1000's of people takes months and sometimes years. Companies have to educate or hire leaders to establish a new baseline. They have to formalize a business strategy and get approval other executives and maybe even the board. Then, they have to provide training to the rank and file employees below. It's a top down process which drags — costing the company time, money and resources. But, more importantly, the ideas from the bottom- the people that are executing the day-to-day work — typically get placed on the back burner because of the cost of implementation.

When Facebook first started, they were a small team that could pivot and implement new features on a daily basis. As they began to grow in users and team size, change became harder and harder to implement with the same speed. Mark Zuckerberg recognized this problem early on in Facebook's growth cycle. Since, then Facebook has been bullish in implementing processes that allow it's team to build, test and validate ideas quickly.

Now they provide boot camps and continued education classes to familiarize every employee with ways they can create and facilitate change with the company. Now, engineers and designers test hundreds of features on small sample sizes of users (a few hundred to a few thousand). If they work, they get scaled to larger groups and get larger teams. If they don't, nothing is loss. There is minimum disturbance to the overall network of users and business operations. As a result of this process, the vertical integration of Facebook's feature testing and implementation is one of the best in the world. They've built resources and channels to work small then scale big — a process that typically plagues older incumbent companies who have an unnecessary levels of approval to take an idea to market or implementation.

Do you have some additional strategies to share? If so, let the world know in the comments. If you liked the article, hit the heart and be sure to follow me for more articles on startups and innovation.

Kevin Boutte is the CEO and co-founder of Neucities ( Formerly BrickBots), a Y Combinator Startup School and online education company looking to change the way professionals build, design and plan cities.